The traditional financial world was designed for a sedentary life. For decades, the roadmap was simple: live in one country, pay taxes to one government, and invest in one local market. But the rise of the digital economy has shattered this model.

If you are a remote professional, a tech consultant, or a digital nomad, you are part of a new class of Global Citizens. Your life is borderless, but your finances often remain trapped in rigid, nationalistic systems. Managing wealth across borders is no longer just a strategy for the ultra-wealthy—it is a survival skill for the modern worker.

This comprehensive guide explores how to build a resilient, tax-efficient, and portable financial life that follows you wherever your laptop goes.

1. The Multi-Tier Banking Infrastructure

The foundation of global wealth management is redundancy. Relying on a single bank in a single country is a point of failure. If that country faces economic instability or freezes your account due to “suspicious” international activity, you are stranded.

Tier 1: The Transactional Hub (Neo-Banks)

For daily expenses, you need agility. Platforms like Wise, Revolut, and Mercury (for those with US entities) allow you to hold dozens of currencies and exchange them at mid-market rates.

- The SEO Tip: Always maintain accounts in at least two different jurisdictions (e.g., one in the EU and one in the US/UK) to ensure liquidity.

Tier 2: The Core Wealth Hub (International Banks)

Neo-banks are great for spending, but they often lack the deposit insurance and long-term stability of traditional institutions. For your core cash reserves, consider “Expat Banking” divisions of major players like HSBC Expat (Jersey), Standard Chartered, or DBS. These accounts are designed for people who do not have a permanent local address.

Tier 3: The Investment Engine

Your banking should be decoupled from your investing. A dedicated international brokerage account—such as Interactive Brokers (IBKR)—is essential. IBKR is the gold standard for remote professionals because it allows you to trade on 150+ markets and hold assets in multiple currencies under one roof.

2. Navigating the Tax Labyrinth (E-E-A-T Focus)

Taxation is the single biggest “wealth killer” for the global professional. Without a clear strategy, you risk Double Taxation—paying the country where your client is located AND the country where you are physically sitting.

Understanding Tax Residency

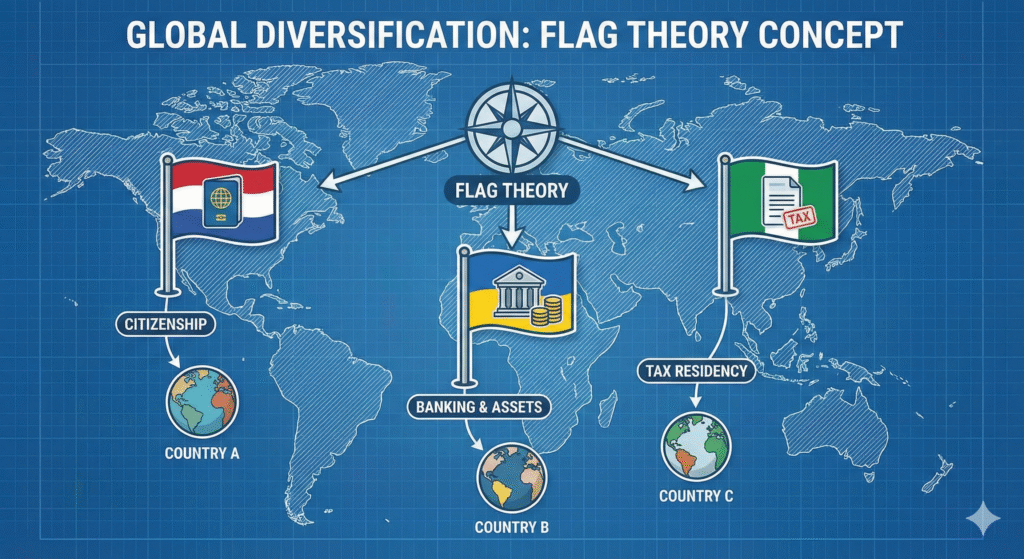

Most people confuse “Citizenship” with “Tax Residency.”

- The 183-Day Rule: Most jurisdictions consider you a tax resident if you spend more than half a year there.

- Territorial vs. Worldwide Taxation: Countries like the US tax their citizens on worldwide income regardless of where they live. Conversely, countries like Panama or Thailand (under certain conditions) only tax income earned within their borders.

Crucial Concepts for 2026:

- FEIE (Foreign Earned Income Exclusion): For US citizens, this is a lifesaver, allowing you to exclude a significant portion of your foreign earnings from US tax—but only if you meet the “Physical Presence” or “Bona Fide Residence” tests.

- Digital Nomad Visas: Countries from Portugal to Indonesia now offer special visas. Some come with tax holidays (like Dubai) or reduced flat taxes (como a Ley Beckham na Espanha).

- Tax Treaties: Always check if your country of residence has a Double Taxation Agreement (DTA) with your country of income. This prevents you from paying the same dollar twice.

3. Investment Strategy: The “Borderless” Portfolio

When you live abroad, your investment choices change. You cannot simply buy a local mutual fund and call it a day.

The Danger of PFICs (For US Persons)

If you are a US citizen living abroad, buying a non-US mutual fund or ETF is a massive tax trap. These are classified as Passive Foreign Investment Companies (PFICs) and are taxed at punitive rates (up to 50%+).

- The Strategy: Stick to US-domiciled ETFs (Vanguard, iShares) regardless of where you live.

Geographic Arbitrage and the 4% Rule

One of the greatest advantages of being a remote professional is Geographic Arbitrage. By earning in a strong currency (USD/EUR) and living in a lower-cost region (Southeast Asia, Latin America, or Eastern Europe), you can achieve a savings rate of 50-70%.

- The Goal: Accelerate your “FIRE” (Financial Independence, Retire Early) timeline by reinvesting the spread into global index funds.

4. Risk Management: Protection Beyond Borders

What happens if you get sick in a country where you don’t pay social security? Or if you lose your laptop in a co-working space?

International Health Insurance

Local insurance is rarely enough. You need Global Private Medical Insurance (GPMI) from providers like SafetyWing, Cigna Global, or Allianz Care.

- Check for: “Medical Evacuation” coverage. If you are in a remote area and need surgery, you want to be flown to a world-class hospital in Singapore or Germany, not stay in a local clinic.

Professional Liability (Errors & Omissions)

If you are a freelancer or consultant, your contracts might be governed by laws in Delaware or London. Ensure your professional liability insurance covers international claims.

5. Estate Planning: The Forgotten Pillar

What happens to your US brokerage account and your Dubai bank account if you pass away? Without a Cross-Border Will, your heirs could face a multi-year legal nightmare in multiple languages.

- Situs Assets: Understand that certain assets are taxed where they are located. US-situated assets (like US stocks) over $60k may be subject to a 40% Estate Tax for non-residents.

- The Solution: Use an offshore holding company or a Trust to hold your global assets, ensuring a seamless transfer to your family without probate.

6. Your 2026 Global Wealth Checklist

To wrap up this pillar guide, here is your actionable roadmap:

- Audit your Tax Residency: Are you accidentally becoming a tax resident of a high-tax country?

- Consolidate Investments: Move scattered accounts into one global brokerage (like IBKR).

- Review Insurance: Does your health plan cover you in 180+ countries?

- Automate Savings: Set up a “pay yourself first” system where 30% of your global income goes directly into an S&P 500 or All-World ETF.

Conclusion

Building wealth as a remote professional is about more than just a high salary; it’s about portability and protection. By implementing a multi-tier banking system and a tax-optimized investment strategy, you ensure that your financial future is as free as your lifestyle.

Do you have questions about a specific country’s tax treaty? Leave a comment below or subscribe to our newsletter for weekly deep dives into global finance.

About the Author: Ivan Baeta is a Certified Financial Planner (CFP®) with over 5 years of experience in helping international professionals navigate the complexities of global finance and cross-border investments.