When it comes to building wealth in the stock market, two of the most popular investment styles are growth investingand value investing. These strategies differ not only in philosophy but also in the types of companies they target and the risks involved.

Understanding the differences—and identifying which approach aligns best with your goals, personality, and timeline—can make a significant difference in your long-term investing success.

In this article, we’ll explore what growth and value investing are, their key differences, advantages and disadvantages, and how to decide which one suits you best.

What is Growth Investing?

Growth investing is the strategy of investing in companies that are expected to grow at a rate significantly above the market average. These companies typically reinvest their earnings into expansion, innovation, or acquisitions rather than paying dividends.

Characteristics of Growth Stocks:

- Rapid revenue and earnings growth

- High price-to-earnings (P/E) and price-to-sales (P/S) ratios

- Often found in tech, biotech, and emerging industries

- Lower or no dividend payouts

- High reinvestment in research, development, and marketing

Common Examples:

- Tesla (TSLA)

- Amazon (AMZN)

- Shopify (SHOP)

- Nvidia (NVDA)

These companies have strong potential for future expansion, even if they currently trade at high valuations.

What is Value Investing?

Value investing is the strategy of investing in companies that are trading for less than their intrinsic value. Value investors look for stocks that appear to be undervalued by the market based on fundamentals such as earnings, dividends, or book value.

Characteristics of Value Stocks:

- Low P/E and P/B (price-to-book) ratios

- Often pay dividends

- Established companies with steady cash flows

- Seen as “on sale” compared to their intrinsic worth

- May be in mature or cyclical industries

Common Examples:

- Johnson & Johnson (JNJ)

- JPMorgan Chase (JPM)

- Procter & Gamble (PG)

- Coca-Cola (KO)

These companies might not offer explosive growth, but they can provide stability and consistent returns.

Key Differences Between Growth and Value Investing

| Aspect | Growth Investing | Value Investing |

|---|---|---|

| Focus | Future potential | Current undervaluation |

| Typical Sectors | Tech, biotech, innovation | Financials, industrials, consumer goods |

| Risk Level | Higher volatility, more risk | Lower volatility, more stability |

| Dividends | Rare or none | Often pays dividends |

| Metrics Used | Revenue growth, user base, potential | P/E, P/B, Dividend Yield, ROE |

| Performance Cycles | Outperforms in bull markets | Outperforms in bear or recovery periods |

Pros and Cons of Growth Investing

Pros:

- High return potential if the company succeeds

- Opportunity to invest in disruptive and innovative businesses

- Strong upside during bullish markets

Cons:

- Often expensive in terms of valuation

- Higher risk of sharp corrections

- Earnings may not materialize as expected

Pros and Cons of Value Investing

Pros:

- Historically lower risk and volatility

- Regular dividend income

- Buying “on sale” can offer long-term upside

Cons:

- Can underperform during growth-driven bull markets

- “Value traps” exist—cheap stocks that stay cheap

- Requires patience; gains may take time

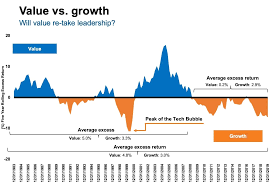

Historical Performance: Which One Wins?

Historically, both strategies have had periods of outperformance.

- Value stocks tended to outperform during the mid-20th century and after financial crises.

- Growth stocks dominated the 2010s, fueled by tech booms and low interest rates.

Data from various decades shows that over long periods, value investing has slightly outperformed growth—but the margins can vary depending on economic cycles, interest rates, and innovation waves.

So, while historical data is insightful, past performance does not guarantee future results.

Which Strategy Suits You?

Choose Growth Investing if:

- You’re young and have a long time horizon

- You’re comfortable with risk and volatility

- You want to invest in innovation and disruptive trends

- You prefer capital appreciation over dividend income

Choose Value Investing if:

- You prefer a conservative approach

- You want consistent income through dividends

- You’re closer to retirement or need lower volatility

- You believe in “buy low, sell high” logic

Can You Combine Both Strategies?

Absolutely. Many investors build blended portfolios that include both growth and value stocks. This approach offers:

- Exposure to innovative companies with high potential

- Stability and income from value stocks

- Diversification across sectors and risk profiles

Example:

You could allocate:

- 60% to growth stocks (or ETFs like QQQ)

- 40% to value stocks (or ETFs like VTV)

Or invest in a balanced ETF that includes both strategies, like the iShares Russell 1000 Blend ETF (IWB).

ETFs for Growth and Value

Growth-Focused ETFs:

- VUG – Vanguard Growth ETF

- QQQ – Invesco Nasdaq 100 ETF

- ARKK – ARK Innovation ETF

Value-Focused ETFs:

- VTV – Vanguard Value ETF

- IWD – iShares Russell 1000 Value ETF

- SCHD – Schwab U.S. Dividend Equity ETF

These funds are ideal for passive investors who want exposure to each strategy without picking individual stocks.

Final Thoughts

Both growth and value investing have their merits. Choosing between them—or combining both—depends on your financial goals, risk tolerance, and investment timeline.

Growth investing can deliver explosive returns, but with higher risk. Value investing offers more stability and income, but may require more patience.

The key is to know yourself and stick to a strategy that aligns with your personal objectives. Don’t chase trends or abandon your plan during volatility. Investing success lies in long-term consistency and discipline—not in trying to guess the next hot stock.

Start small, stay diversified, and let your strategy grow with you.