Investing can feel daunting, especially when you see headlines screaming about market crashes one day and record highs the next. A common question plagues many beginner investors: “When is the right time to invest?” Trying to perfectly time the market – buying low and selling high – is notoriously difficult, even for seasoned professionals. Market volatility, the constant ups and downs in prices, can feel like a barrier. But what if there was a simple, less stressful strategy that helps you navigate these choppy waters and build wealth steadily over time? Enter Dollar-Cost Averaging (DCA). This powerful yet straightforward investment strategy takes the guesswork out of timing the market and can be a fantastic tool, particularly for beginner investors looking to harness the potential of long-term investing despite market volatility. This guide will explain what is DCA, how it works, and why it holds significant power for building your financial future.

What is Dollar-Cost Averaging (DCA)?

So, what is DCA exactly? At its core, Dollar-Cost Averaging is an investment strategy where you commit to investing a fixed amount of money into a specific investment at regular intervals, regardless of what the price is doing at that moment. Instead of trying to guess whether the market will go up or down, you simply invest consistently – say, $100 every month.

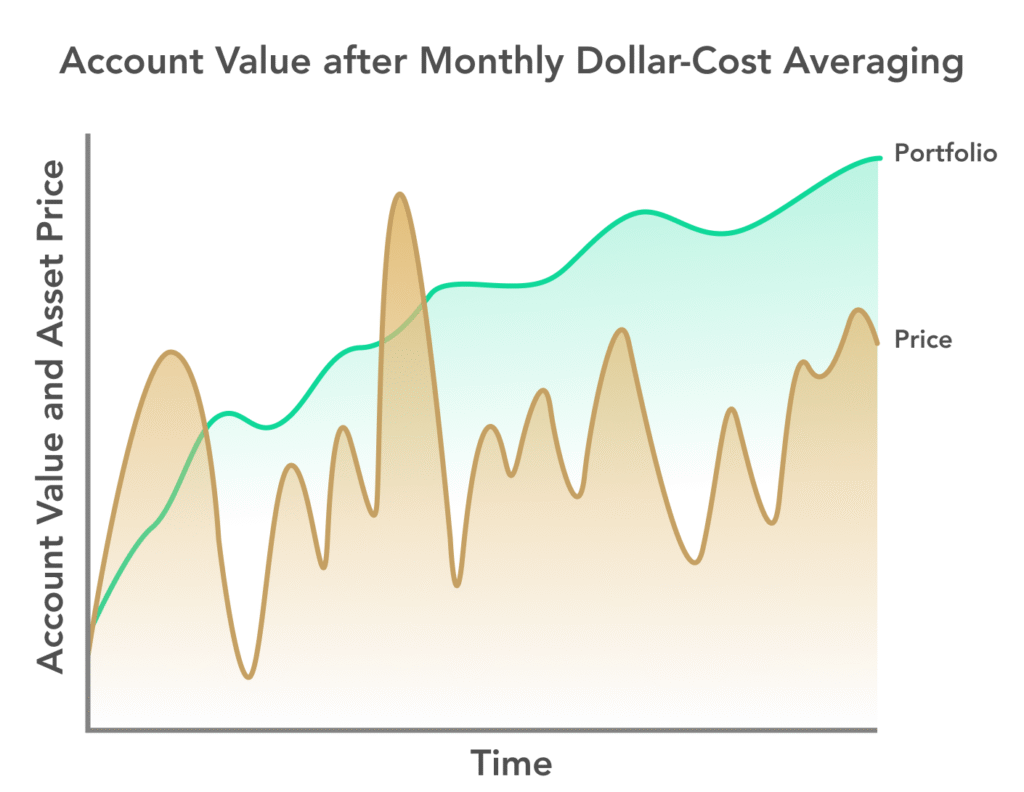

The magic lies in the core principle: when the price of your chosen investment (like a stock or an ETF) is lower, your fixed dollar amount automatically buys more shares. When the price is higher, that same fixed amount buys fewer shares. Think about buying gasoline for your car. You probably don’t wait for the price to hit rock bottom; you fill up when you need gas, maybe putting in $40 worth each time. Sometimes that $40 buys you more gallons, sometimes fewer, depending on the price per gallon. DCA applies a similar disciplined approach to investing, focusing on consistency rather than timing.

How Does Dollar-Cost Averaging Work in Practice? (With Example)

Understanding the mechanics of DCA is best done with a simple example. Let’s say you decide to use dollar-cost averaging to invest $100 every month into a hypothetical Exchange-Traded Fund (ETF) over four months. Here’s how it might play out:

- Month 1: The ETF price is $10 per share. Your $100 investment buys you 10 shares ($100 / $10 per share).

- Month 2: The market dips, and the ETF price drops to $8 per share. Your $100 investment now buys you 12.5 shares ($100 / $8 per share). You automatically bought more shares because the price was lower.

- Month 3: The market recovers, and the ETF price rises to $12 per share. Your $100 investment buys you 8.33 shares ($100 / $12 per share). You bought fewer shares this month because the price was higher.

- Month 4: The ETF price settles back at $10 per share. Your $100 investment buys you another 10 shares ($100 / $10 per share).

Now, let’s look at the results after four months:

- Total Amount Invested: $400 ($100 x 4 months)

- Total Shares Purchased: 40.83 shares (10 + 12.5 + 8.33 + 10)

- Average Cost Per Share: $9.80 ($400 total invested / 40.83 total shares)

Notice something important: the average price of the ETF over these four months was $10 (($10 + $8 + $12 + $10) / 4). However, your average cost per share using DCA was only $9.80. By consistently investing the same amount, you naturally bought more shares when the price was low, pulling your average cost down. This is the core mechanism of how DCA works to potentially reduce your investment cost over time, especially in fluctuating markets.

The best part? This process can often be automated. Most brokerage accounts allow you to set up automatic investing plans, transferring a set amount from your bank account and investing it into your chosen funds on a regular schedule. This “set it and forget it” approach makes DCA incredibly easy to implement.

The Key Benefits of Dollar-Cost Averaging for Investors

Why has dollar-cost averaging become such a popular and recommended strategy, especially for those new to investing or focused on the long term? It offers several compelling DCA benefits:

Reduces Market Timing Risk

Trying to time the market perfectly is often a losing game. DCA removes this pressure entirely. By investing consistently, you avoid the risk of putting all your money in right before a significant market drop. You accept that you won’t buy everything at the absolute bottom, but you also protect yourself from buying everything at the absolute top. It’s a strategy that acknowledges the difficulty of market timing.

Mitigates Impact of Volatility

Market volatility can be scary, but DCA turns it into a potential advantage. When prices fall, your fixed investment buys more shares, which can significantly enhance your returns when the market eventually recovers. DCA helps smooth out the bumps in the road, making the investment journey less stressful during turbulent times and helping you potentially achieve a lower average cost.

Encourages Disciplined Investing

Emotion is often the enemy of successful investing. Fear might make you sell during downturns, and greed might make you buy frantically near market peaks. DCA enforces discipline. By committing to a regular investment habit, you take emotion out of the equation and stick to your long-term investing plan, which is crucial for building wealth over time. It fosters a disciplined investing mindset.

Makes Investing Accessible

You don’t need a large lump sum to start investing with DCA. You can begin with smaller, manageable amounts that fit your budget. This accessibility makes it an ideal strategy for beginners, young investors, or anyone building their portfolio gradually through regular contributions, like from paychecks.

Potential for Lower Average Cost

As seen in our example, because you buy more shares when prices are low and fewer when they are high, DCA can result in an average cost per share that is lower than the average market price during the investment period. This is particularly true in markets that fluctuate or trend sideways before moving higher.

Are There Any Downsides? Understanding the Risks of DCA

While DCA offers significant advantages, it’s not without potential drawbacks or DCA risks. It’s important to have a balanced view:

- Potential for Lower Returns (vs. Lump Sum in Rising Markets): This is the main mathematical counterargument. If the market experiences a strong, consistent upward trend right after you receive a sum of money, investing it all at once (lump sum investing) at the beginning would likely result in higher returns than spreading it out via DCA. By holding cash and investing it gradually, you miss out on potential gains during that rising period.

- Transaction Costs: If your brokerage charges fees for each trade, making frequent small investments through DCA could lead to higher overall transaction costs compared to a single lump sum investment. However, with the rise of commission-free trading platforms for stocks and ETFs, this disadvantage has become less significant for many investors.

- Doesn’t Guarantee Profit or Prevent Loss: It’s crucial to remember that DCA is a strategy for how to invest, not what to invest in. It doesn’t guarantee that your investments will make money or protect you from losses if the underlying asset performs poorly over the long term. Your ultimate return still depends heavily on the quality of the investments you choose.

Dollar-Cost Averaging vs. Lump Sum Investing: Which is Better?

This is a common debate: if you suddenly have a significant amount of money to invest (e.g., an inheritance, bonus, or savings), should you invest it all at once (Lump Sum Investing or LSI) or deploy it gradually using DCA?

Mathematically and historically, studies (including well-known research from Vanguard) often show that LSI tends to outperform DCA about two-thirds of the time. The simple reason is that, historically, markets trend upward more often than they trend downward. Therefore, getting your money into the market sooner (via LSI) gives it more time to potentially benefit from this general upward trend.

However, the dollar-cost averaging vs lump sum debate isn’t just about math; it’s also about behavioral finance. While LSI might be statistically optimal on average, it can be psychologically challenging. Investing a large sum right before a market downturn can lead to significant regret and might even scare an investor into selling at the worst possible time. DCA provides a psychological cushion. It mitigates the risk of investing at a peak and helps investors stay the course, which is often more important for long-term success than achieving the absolute maximum mathematical return.

So, when might DCA be preferred even with a lump sum?

- If you’re investing regular income (like from paychecks), DCA is the natural approach.

- If you receive a large windfall and feel anxious about investing it all at once due to fear of a market drop.

- During periods of particularly high perceived market volatility when the psychological benefit of easing in feels more comfortable.

The “best” strategy in the investment comparison often depends less on unknowable future market conditions and more on the individual investor’s risk tolerance and their ability to stick with the chosen plan without panicking.

How to Implement Dollar-Cost Averaging

Ready to put DCA into action? Here’s how to start DCA:

- Choose Your Investment(s): DCA works well with investments that you plan to hold for the long term and expect to grow over time, despite short-term fluctuations. Broad-market index funds or ETFs are popular choices as they offer diversification.

- Determine Your Fixed Amount: Decide how much money you can consistently commit to investing at each interval. It should be an amount you can stick with even if your financial situation changes slightly.

- Set Your Schedule: Choose how often you’ll invest – monthly is very common, but it could be bi-weekly, quarterly, or aligned with your paychecks.

- Automate the Process: This is key to harnessing the behavioral benefits of DCA. Set up an automatic investing plan through your brokerage account. Arrange for automatic transfers from your bank account to your brokerage, and set up recurring investments into your chosen funds.

- Stay Consistent: The most crucial part of DCA is sticking to the investment plan. Resist the urge to pause investments when markets look scary or to invest extra when markets seem hot. Let the strategy work by maintaining consistency.

Conclusion: Harnessing the Power of Consistency

Dollar-Cost Averaging is more than just an investment strategy; it’s a powerful framework for building wealth through discipline and consistency. By investing a fixed amount regularly, you remove the stress of market timing, mitigate the impact of market volatility, and cultivate a healthy, long-term investment habit. While it might not always produce the absolute highest mathematical return compared to perfectly timed lump sum investing (which is impossible to achieve consistently), its behavioral benefits are immense, helping investors stay invested and avoid costly emotional mistakes.

For beginner investors and anyone focused on long-term investing, DCA offers a simple, accessible, and effective way to navigate the markets and steadily build a portfolio over time. Its true power lies not in complex algorithms, but in the simple act of consistent, disciplined action. Remember, consistency is often the unsung hero of investment success. Consider incorporating dollar-cost averaging into your regular investment routine, and if you’re unsure how it fits into your broader financial picture, consulting with a qualified financial advisor is always a wise step.