Investing isn’t just about picking the right assets — it’s also about understanding when you’re investing. One of the most overlooked, yet powerful, concepts in the financial world is the idea of market cycles.

Market cycles affect everything: stock prices, bond yields, real estate performance, and even investor psychology. If you can recognize where we are in the market cycle, you can make more strategic decisions and potentially avoid costly mistakes.

In this guide, we’ll explore what market cycles are, how they work, and how you can align your investments with the different stages of the cycle to improve your financial results.

What Are Market Cycles?

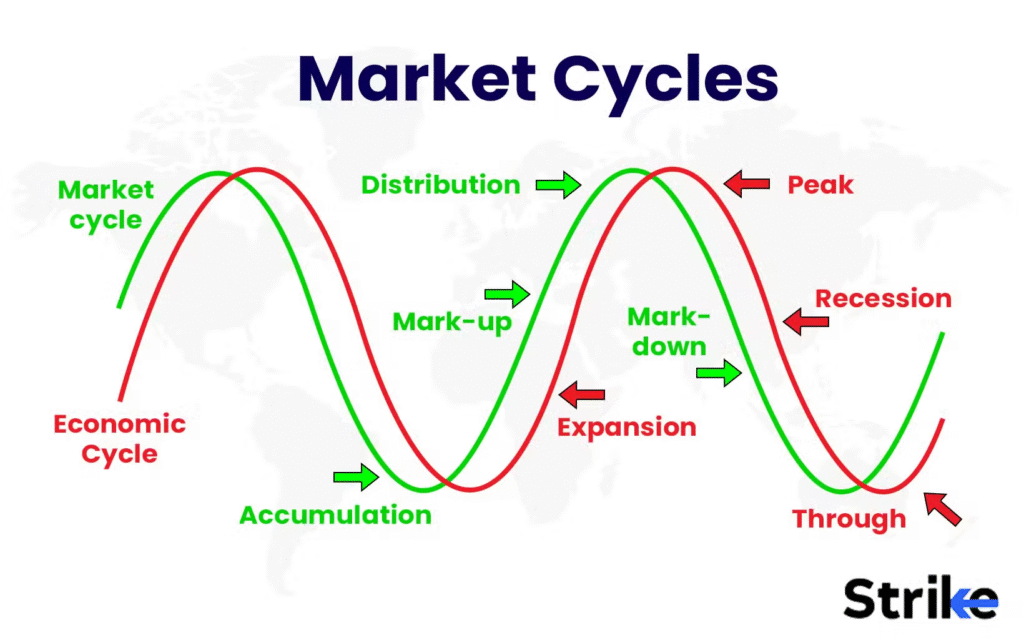

A market cycle is a recurring pattern of economic expansion and contraction that impacts asset prices and investor sentiment over time. While the exact timing and length of each cycle varies, the pattern generally follows four distinct phases:

- Expansion (Recovery/Growth)

- Peak (Euphoria)

- Contraction (Recession)

- Trough (Depression/Panic)

These cycles can apply to the overall economy, specific sectors, or even individual asset classes.

Key Concept: Markets Are Cyclical, Not Linear

Contrary to what many new investors believe, markets don’t go up forever in a straight line. They move in cycles influenced by economic indicators, interest rates, inflation, earnings, and global events.

The Four Phases of a Market Cycle

Let’s break down each phase in more detail and see how it affects your investments.

1. Expansion (Recovery and Growth)

This is the period following a market bottom (trough). The economy begins to grow again, companies increase earnings, unemployment falls, and consumer confidence rises.

Key Characteristics:

- GDP grows steadily

- Interest rates are typically low

- Consumer spending and business investments increase

- Stock markets start trending upward

Investment Strategy:

- Equities perform well, especially cyclical sectors like tech, consumer discretionary, and real estate.

- Small-cap stocks and growth stocks often outperform.

- It’s a good time to enter the market and ride the wave of recovery.

2. Peak (Euphoria)

At the peak of the market cycle, optimism is high. Asset prices may rise to unsustainable levels driven more by sentiment than fundamentals.

Key Characteristics:

- GDP growth hits its peak

- Inflation may start rising

- Central banks begin tightening monetary policy (raising interest rates)

- Stock prices are at all-time highs

- Investors become overconfident

Investment Strategy:

- It’s a time for caution. Valuations may be stretched.

- Consider reducing exposure to overvalued assets.

- Rotate into defensive sectors like utilities, consumer staples, or healthcare.

- Increase allocations to fixed income or less volatile investments.

3. Contraction (Recession or Market Decline)

This is the most challenging phase for investors. Economic activity slows down, unemployment rises, and corporate earnings fall.

Key Characteristics:

- GDP contracts

- Consumer confidence weakens

- Central banks may cut rates to stimulate growth

- Markets may fall sharply (bear market)

- Panic often sets in

Investment Strategy:

- Focus on capital preservation.

- Allocate more to bonds, cash equivalents, or defensive stocks.

- Avoid high-risk or speculative assets.

- If you’re a long-term investor, this phase offers buying opportunities for quality assets at discounted prices.

4. Trough (Bottom and Stabilization)

The downturn hits bottom, and while the economy may still be struggling, the worst is behind. Markets begin to price in future recovery even before economic data improves.

Key Characteristics:

- Stock prices start rising even as news remains negative

- Value stocks may outperform growth

- Smart money begins entering the market

- Central banks continue to support the economy

Investment Strategy:

- Start building positions in undervalued stocks

- Diversify across different sectors and geographies

- Re-enter risk assets cautiously

- This is the phase where fortunes are made by buying low

How Long Do Market Cycles Last?

Market cycles don’t follow a fixed schedule. Historically, cycles have ranged from a few years to over a decade.

- The average bull market (expansion to peak) lasts about 5–8 years

- The average bear market (peak to trough) lasts about 1–2 years

However, global events, monetary policies, and technological disruptions can shorten or extend cycles.

Historical Examples of Market Cycles

Dot-com Bubble (1995–2002)

- Expansion: Late ’90s tech boom

- Peak: 2000 (Nasdaq reached unsustainable highs)

- Contraction: 2000–2002 crash

- Trough: 2002–2003, slow recovery

Global Financial Crisis (2003–2009)

- Expansion: 2003–2007 housing boom

- Peak: 2007

- Contraction: 2008–2009 (Lehman collapse)

- Trough: March 2009, market began long bull run

COVID-19 Crash and Recovery (2020)

- Expansion: 2010–2020 decade-long bull market

- Peak: February 2020

- Contraction: March 2020 crash

- Trough: March 23, 2020

- Expansion: Rapid recovery fueled by stimulus and low interest rates

How Market Cycles Affect Different Asset Classes

Different assets perform better (or worse) depending on the cycle phase.

| Cycle Phase | Best Performing Assets | Worst Performing Assets |

|---|---|---|

| Expansion | Stocks (Growth, Small Cap), REITs | Bonds, Gold |

| Peak | Defensive Stocks, Real Assets | High-Risk Stocks |

| Contraction | Bonds, Gold, Cash | Stocks, Real Estate |

| Trough | Value Stocks, Emerging Markets | Speculative Assets |

The Role of Central Banks and Interest Rates

Monetary policy, especially by central banks like the Federal Reserve or Banco Central do Brasil, has a major impact on market cycles.

- Low interest rates encourage borrowing, spending, and investing → economic expansion

- High interest rates cool off inflation but slow down the economy → contraction

Investors should pay close attention to interest rate policies, as they can be early indicators of a shift in the market cycle.

How to Invest According to Market Cycles

You don’t need to perfectly predict the cycle to benefit from this knowledge. But by observing trends and economic signals, you can adjust your asset allocation to reduce risk and capture opportunities.

Tips for Aligning with the Cycle:

- Use Leading Indicators

- Look at unemployment, interest rate trends, and consumer sentiment.

- Rebalance Periodically

- As cycles shift, adjust your portfolio to fit the new phase.

- Don’t Try to Time the Market Perfectly

- Instead, focus on trend awareness and managing exposure.

- Stay Diversified

- Diversification helps smooth returns through every cycle phase.

- Take a Long-Term Perspective

- All market downturns in history have eventually recovered. Stay invested.

Emotional Cycles in Investing

Market cycles aren’t just economic — they’re also emotional. Recognizing emotional phases can prevent panic selling or overconfidence.

| Market Phase | Emotional Phase |

|---|---|

| Expansion | Optimism, Excitement |

| Peak | Euphoria |

| Contraction | Anxiety, Panic |

| Trough | Despair, Hope |

Smart investors understand both economic and emotional cycles — and prepare for both.

Final Thoughts

Understanding market cycles is like learning to read the rhythm of the financial world. You won’t always know the exact timing, but recognizing where we are can help you:

- Make better investment decisions

- Manage risk

- Buy low and sell high

- Avoid emotional mistakes

In the end, you don’t need to fight the cycle — you need to ride it. Align your strategy with the broader trends and stay informed, disciplined, and diversified.

Would you like a market cycle cheat sheet or chart to share with your audience? I can generate a visual to accompany this article — just say the word!